1

Please refer to important disclosures at the end of this report

1

1

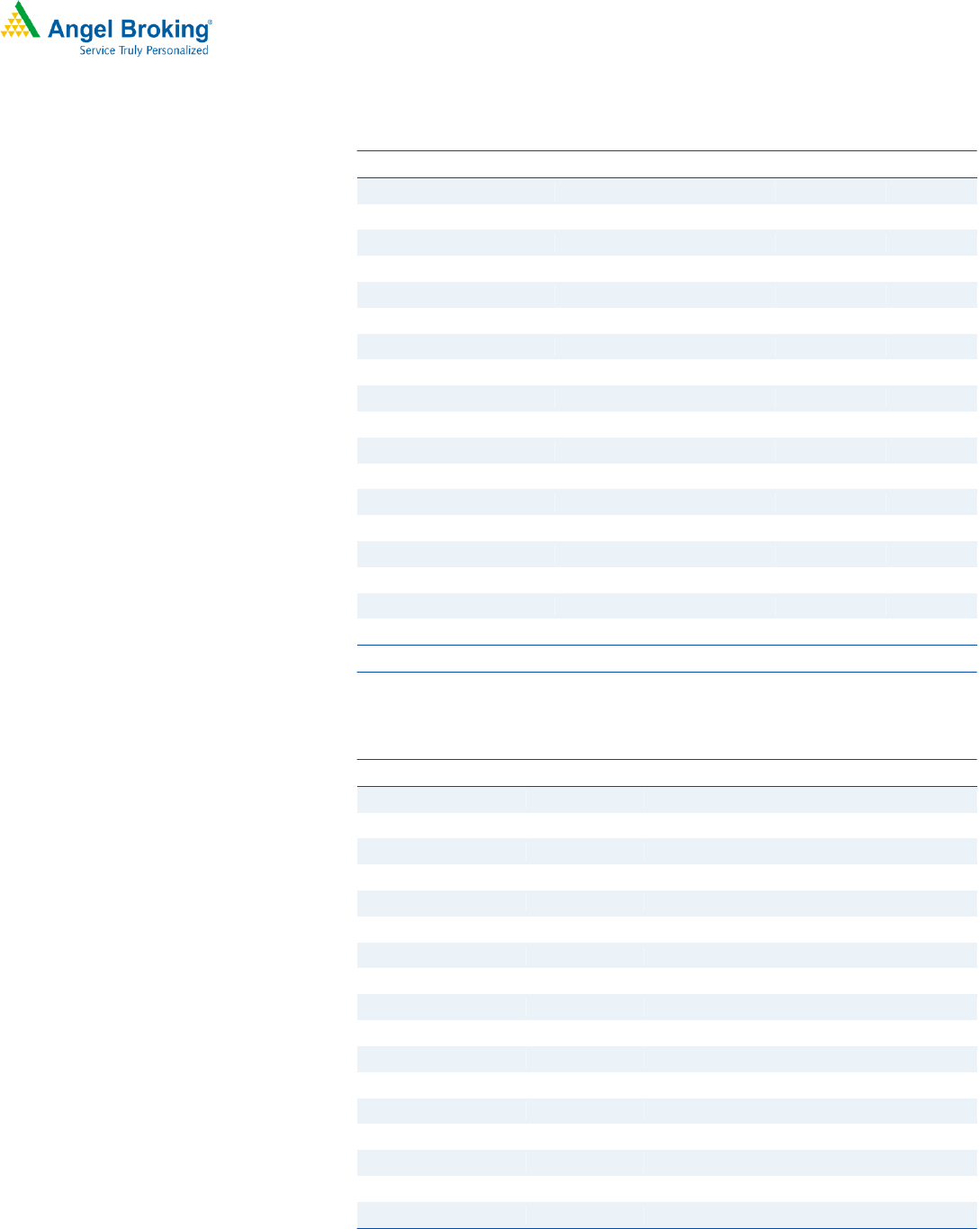

Quarterly Summary:

Y/E March (` cr)

Q3FY20

Q3Y19

% yoy

Q2FY20

% qoq

Revenue

10,354

10,444

(0.9)

9,620

7.6

EBITDA

1,973

1,595

23.7

1,918

2.9

OPM (%)

19.1

15.3

380bps

19.9

(80 bps)

Adjusted PAT

711

394

81

579

23

Source: Company, Angel Research

Robust performance in muted demand environment: In Q3FY20, consolidated

revenue declined by 1% while EBIDTA and PAT grew by 23.7% and 81% YoY

respectively. Operating margin also improved by 3.8% YoY to 19.1% due to

better realizations & cost control. Sales volume declined by 4% YoY to 20.9mn

tonne. EBIDTA/ tonne increased by 35.5% YoY to `1004.

Favorable Cost trends (excluding Century Cement): Logistics cost as well as

energy cost declined 5% and 15% YoY to `1108 and `941 per tonne respectively.

Raw material cost and other cost (excluding Sabka Vishwas charge) increased by

2% and 6% YoY to `941 and `707 per tonne respectively. During the quarter

`133cr. was incurred for one time settlement against contingent and other

disputed liabilities of `832cr. of Sabka Vishwas Scheme.

Expansion Plan: 3.4 mtpa grinding capacity expansions in the Eastern markets

and Dalla SuperUnit, which is a 2.3 mtpa clinker plant are expected to be

commission by March 2021. The Phase-II of Bara is expected to be commissioned

by September 2020.

Outlook and Valuation: We are positive on the long term prospects of the

Company given ramp up from acquired capacities, pricing discipline in the

industry and benign energy & freight costs. We maintain our “Buy”

recommendation on UltraTech by valuing it at 13x FY22E EV/EBIDTA to arrive at

a target price of `5373.

Key Financials

Y/E March (` cr)

FY18

FY19

FY20E

FY21E

FY22E

Net Sales

30,978.6

37,379.2

43,687.9

47,182.0

51,811.7

% chg

22.1

20.7

16.9

8.0

9.8

Net Profit

2,224.6

2,431.1

4,001.4

5,109.3

6,175.3

% chg

-18.0

9.3

64.6

27.7

20.9

EBITDA (%)

19.8

18.2

22.6

23.6

24.0

EPS (Rs)

80.9

88.7

138.6

177.0

214.0

P/E (x)

55.4

50.6

32.4

25.3

21.0

P/BV (x)

4.7

4.3

3.5

3.1

2.7

RoE (%)

8.75

8.89

12.18

12.88

13.77

RoCE (%)

10.92

9.58

13.31

14.59

16.67

EV/EBITDA

23.6

22.1

14.8

12.7

10.9

EV/Sales

4.7

4.0

3.3

3.0

2.6

Source: Company, Angel Research (Valuation done as on 30/01/20)

BUY

CMP `4486

Target Price `5373

Investment Period 12 months

Stock Info

Sector

Bloomberg Code

Shareholding Pattern (%)

Promoters

MF / Banks / Indian Fls

FII / NRIs / OCBs

Indian Public / Others

Abs. (%) 3m 1yr 3yr

Sensex 1.5 14.9 46.9

Ultraterch Cement 8.9 31.6 22.4

Cement

BSE Sensex

40,913

Nifty

12,035

ULTC.NS

Reuters Code

UTCEM:IN

60.2

13.1

17.6

9.1

Net Debt (` cr)

Market Cap (` cr)

129,474

86,225

Beta

1.3

52 Week High / Low

4905/3365

Avg. Daily Monthly Volume

633,517

Face Value (`)

10

Price Chart

Source: Company, Angel Research

Research Analyst

Jyoti Roy

+022 39357600, Extn: 6842

jyoti.roy@angelbroking.com

Keshav Lahoti

+022 39357600, Extn: 6363

keshav.lahoti@angelbroking.com

3,000

3,500

4,000

4,500

5,000

5,500

Feb-17

May-17

Jul-17

Oct-17

Jan-18

Apr-18

Jul-18

Oct-18

Jan-19

Apr-19

Jul-19

Oct-19

Jan-20

UltraTech Cement

Performance Update

Q3FY2020 Result Update | Cement

January 30, 2020

2

UltraTech Cement | Q3FY2020 Result Update

January 30, 2020

2

Q3FY20 Performance

Y/E March (` cr)

Q3FY20

Q3Y19

% yoy

Q2FY20

% qoq

FY2020E

FY2019

% chg

Net Sales

10353.8

10444.1

-0.9

9620.5

7.6

43687.9

37379.2

16.9

Cost of Materials Consumed

1788.1

1779.7

0.5

1523.8

17.3

6944.1

6527.1

6.4

(% of Sales)

17.3

17.0

15.8

15.9

17.5

Employee Benefit Expense

620.0

597.1

3.9

638.4

-2.9

2487.4

2058.8

20.8

(% of Sales)

6.0

5.7

6.6

5.7

5.5

Power & Fuel

2039.4

2480.0

-17.8

1965.8

3.7

8934.2

8427.9

6.0

(% of Sales)

19.7

23.7

20.4

20.5

22.5

Freight & Forwarding Expense

2343.8

2552.1

-8.2

2115.5

10.8

9609.9

8846.7

8.6

(% of Sales)

22.6

24.4

22.0

22.0

23.7

Other Expenses

1589.4

1440.6

10.3

1459.0

8.9

5900.8

4730.5

24.7

(% of Sales)

15.4

13.8

15.2

13.5

12.7

Total Expenditure

8380.8

8849.6

-5.3

7702.4

8.8

33876.5

30591.0

10.7

Operating Profit

1973.0

1594.5

23.7

1918.1

2.9

9811.4

6788.2

44.5

OPM margin

19.1

15.3

19.9

22.5

18.2

Interest

470.8

478.4

-1.6

507.1

-7.2

1869.2

1548.5

20.7

Depreciation

673.0

638.1

5.5

668.4

0.7

2761.5

2139.8

29.1

Other Income

168.2

112.4

49.6

153.7

9.4

540.0

438.0

PBT (excl. Ext Items)

997.3

590.4

68.9

896.2

11.3

5720.7

3537.9

61.7

Exceptional item (Income)/Expense

0.0

0.0

0.0

6.2

0.0

0.0

0.0

Share of profit/ (loss) of associates & JV

0.1

0.2

-0.2

PBT (incl. Ext Items)

997.4

590.6

68.9

889.8

12.1

5720.7

3537.9

61.7

(% of Sales)

9.6

5.7

9.2

13.1

9.5

Provision for Taxation

286.2

196.8

311.3

1773.4

1106.8

Taxation pertaining to earlier years

0.0

0.0

0.0

0.0

0.0

(% of PBT)

28.7

33.3

35.0

31.0

31.3

Reported PAT

711.3

393.8

80.6

578.6

22.9

3947.3

2431.1

62.4

Adjusted PAT

711.3

393.8

578.6

3947.3

2431.1

PATM

6.9

3.8

6.0

9.0

6.5

Source: Company, Angel Research

3

UltraTech Cement | Q3FY2020 Result Update

January 30, 2020

3

Concall Highlights: Signs of demand revival were visible in some parts during the

latter part of Q3FY20. Phase-I of 2 mtpa Bara grinding unit has been

commissioned in January 2020. Company sold 0.6 MMT units in Bangladesh for

EV of $30mn. UltraTech Nathdwara has become PBT accretive. Nathdwara is

consistently operating at 60% utilization and generating `1500 plus EBIDTA/tonne

Cement prices dropped by 4% QoQ. Company has clarified that it has not bid for

Emami cement plant.

Further debt reduction: Net debt stood at `22,111cr. at the start of F.Y. which was

reduced by `1,492cr. in H1FY20. Net debt is further reduced by `1,994cr. during

the quarter to `18,625cr.

Downside risks to our estimates

Muted demand.

Reduced Infrastructure spends by Government.

Capacity addition at faster pace.

Delay in synergy benefits from inorganic expansion.

4

UltraTech Cement | Q3FY2020 Result Update

January 30, 2020

4

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2019

FY2020E

FY2021E

FY2022E

Revenue

37,379

43,688

47,182

51,812

% chg

20.7

16.9

8.0

9.8

Total Expenditure

30,591

33,826

36,054

39,378

Cost of Materials Consumed

6,527

6,945

7,650

8,482

Employee Benefit Expense

2,059

2,487

2,686

2,921

Power & Fuel

8,428

8,553

9,146

10,043

Freight & Forwarding Expense

8,847

9,610

10,378

11,397

Other Expenses

4,731

6,230

6,194

6,535

EBITDA

6,788

9,862

11,128

12,433

% chg

10.5

45.3

12.8

11.7

(% of Net Sales)

18.2

22.6

23.6

24.0

Depreciation& Amortisation

2,140

2,751

2,976

3,029

EBIT

4,648

7,110

8,152

9,404

% chg

8.2

53.0

14.7

15.4

(% of Net Sales)

12.4

16.3

17.3

18.2

Interest & other Charges

1,549

1,851

1,297

925

Other Income

438

540

550

470

(% of PBT)

12.4

9.3

7.4

5.3

Recurring PBT

3,538

5,799

7,405

8,950

% chg

(3.0)

63.9

27.7

20.9

Exceptional Items

-

-

-

-

Tax

1,107

1,798

2,295

2,774

Current & deferred tax

1,107

1,798

2,295

2,774

Taxation pertaining to earlier years

-

-

-

-

(% of PBT)

31.3

31.0

31.0

31.0

PAT (reported)

2,431

4,001

5,109

6,175

ADJ. PAT

2,431

4,001

5,109

6,175

% chg

(5.4)

64.6

27.7

20.9

(% of Net Sales)

6.5

9.2

10.8

11.9

Basic EPS (Rs)

88.7

138.6

177.0

214.0

Fully Diluted EPS (Rs)

88.7

138.6

177.0

214.0

% chg

9.7

56.3

27.7

20.9

Source: Company, Angel Research

5

UltraTech Cement | Q3FY2020 Result Update

January 30, 2020

5

Consolidated Balance Sheet

Y/E March (` cr)

FY2019

FY2020E

FY2021E

FY2022E

SOURCES OF FUNDS

Equity Share Capital

275

289

289

289

Reserves& Surplus

28,114

37,040

41,715

47,421

Shareholders Funds

28,389

37,329

42,004

47,710

Minority Interest

12

11

10

10

Total Debt

22,818

18,318

14,118

9,000

Other Liabilities

172

190

209

225

Net Deferred tax

3,542

4,325

5,324

5,324

Total Liabilities

54,934

60,172

61,665

62,270

APPLICATION OF FUNDS

Gross Block

49,715

58,178

59,678

60,278

Less: Acc. Depreciation

6,427

8,278

9,575

10,500

Net Block

43,289

49,901

50,451

50,921

Capital Work-in-Progress

1,122

900

800

600

Goodwill on Consolidation

2,847

2,847

2,847

2,847

Non current Investments

1,405

1,500

1,550

1,600

Other non-current assets

4,106

4,800

5,500

5,600

Current Assets

11,755

11,248

12,609

13,791

Investment

1,516

1,540

1,570

1,520

Inventories

3,585

3,800

4,030

4,380

Sundry Debtors

2,531

2,753

2,973

3,265

Cash & Bank Balance

707

741

1,220

1,761

Loans & Advances

3,415

2,415

2,815

2,865

Current liabilities

9,590

11,024

12,091

13,089

Net Current Assets

2,165

225

518

702

Total Assets

54,934

60,172

61,665

62,270

Source: Company, Angel Research

6

UltraTech Cement | Q3FY2020 Result Update

January 30, 2020

6

Consolidated Cash Flow

Y/E March (` cr)

FY2019

FY2020E

FY2021E

FY2022E

Net Profit

3,538

5,799

7,405

8,950

Depreciation

2,140

2,751

2,976

3,029

Interest

1,454

1,851

1,297

925

Change in Working Capital

(937)

1,642

(934)

(287)

Others

(325)

-

-

-

Taxes paid

(710)

(1,015)

(1,296)

(2,774)

Cash Flow from Operations

5,160

11,028

9,448

9,841

(Inc.)/ Dec. in Fixed Assets

(1,504)

(2,100)

(3,426)

(3,299)

(Inc.)/ Dec. in Investments

2,749

(659)

(630)

(470)

Cash Flow from Investing

1,245

(2,759)

(4,056)

(3,769)

Issue of Equity

5

-

-

-

Inc./(Dec.) in borrowings

(4,138)

(7,018)

(4,200)

(5,118)

Dividend(includind DDt)

(346)

(400)

(435)

(469)

Interest paid

(1,484)

(1,851)

(1,297)

(925)

Others

(83)

540

550

470

Cash Flow from Financing

(6,045)

(8,729)

(5,382)

(6,043)

Inc./(Dec.) in Cash

360

(459)

10

30

Opening Cash balances

77

437

(22)

(12)

Closing Cash balances

437

(22)

(12)

18

Source: Company, Angel Research

Key Ratios

Y/E March

FY2019

FY2020E

FY2021E

FY2022E

Valuation Ratio (x)

P/E (on FDEPS)

50.6

32.4

25.3

21.0

P/CEPS

24.9

17.2

14.3

14.1

P/BV

4.3

3.5

3.1

2.7

EV/Sales

4.0

3.3

3.0

2.6

EV/EBITDA

22.1

14.8

12.7

10.9

EV / Total Assets

10.1

11.8

10.1

8.9

Per Share Data (Rs)

EPS (Basic)

88.7

138.6

177.0

214.0

EPS (fully diluted)

88.7

138.6

177.0

214.0

Cash EPS

179.9

261.1

314.8

318.9

DPS

10.5

11.5

12.5

13.5

Book Value

1,033.7

1,293.4

1,455.4

1,653.1

Returns (%)

ROE

8.9

12.2

12.9

13.8

ROCE

9.6

13.3

14.6

16.7

Angel ROIC (Pre tax)

11.4

15.5

16.9

19.5

Source: Company, Angel Research (Valuation done as on 30/01/20)

7

UltraTech Cement | Q3FY2020 Result Update

January 30, 2020

7

Research Team Tel: 022 - 39357800 E-mail: research@angelbroking.com Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement UltraTech Cement

1. Financial interest of research analyst or Angel or his Associate or his relative No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives No

3. Served as an officer, director or employee of the company covered under Research No

4. Broking relationship with company covered under Research No

Ratings (Based on Expected Returns: Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%)

Over 12 months investment period) Reduce (-5% to -15%) Sell (< -15%)

Hold (Fresh purchase not recommended)